Visual Merchandising: Simplified

Uncomplicate your store planning with One Door’s comprehensive visual merchandising platform. Deliver perfect in-store experiences that drive sales.

Work Better Together

One Door’s platform helps you work collaboratively to create, communicate, and execute exceptional in-store experiences. It consolidates data, digitizes and streamlines processes, and enables real-time communication between internal teams, vendors, and stores so everyone is always on the same page.Who uses our platform

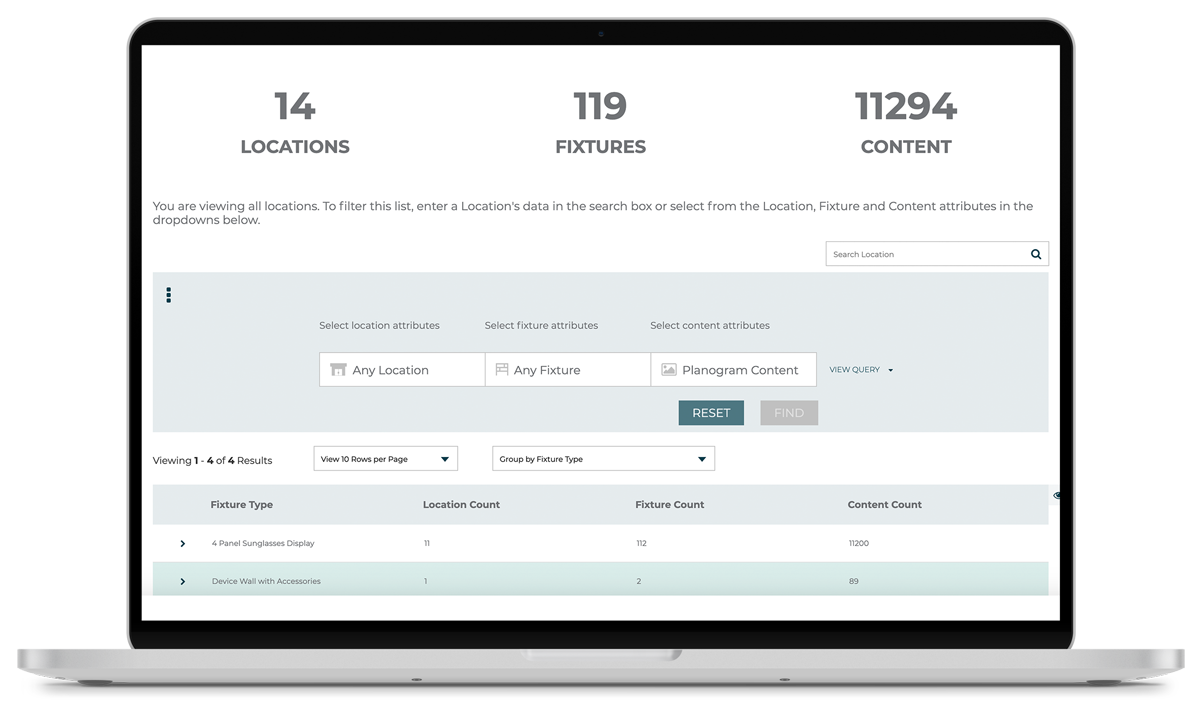

Plan For Each Location

Today’s retail stores are unique combinations of different layouts and customer demands. One Door radically simplifies localized planning, automatically tailoring plans and distribution counts for each store so visual merchandising teams can maximize sales while minimizing costs.

Learn More

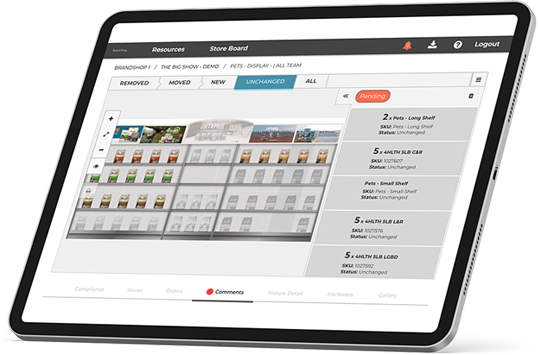

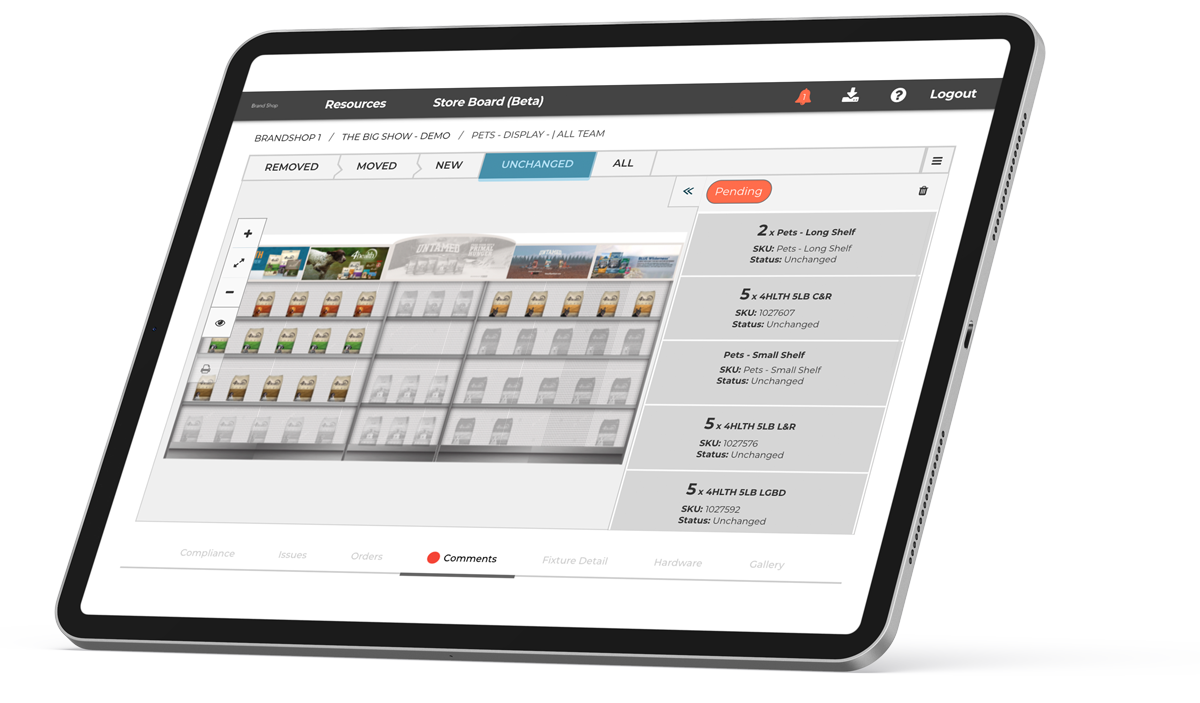

Show Stores What Good is with AI

Today’s store teams wear many hats. One Door gives stores interactive, step-by-step, visual merchandising guides, including AI-based real-time feedback. The result is that teams complete work in 20-30% less time, and get displays right on day one.

Learn More

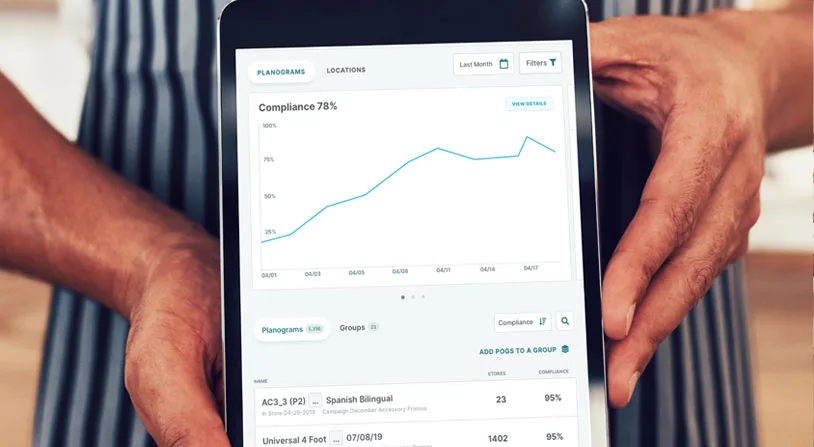

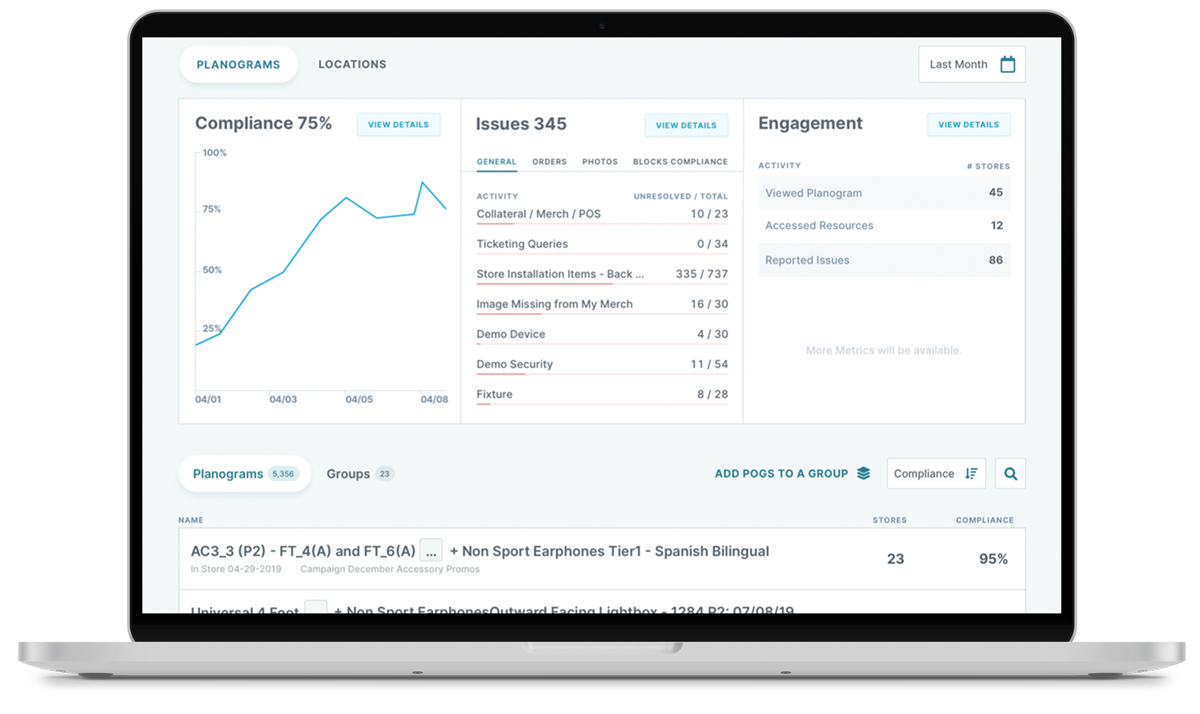

See What’s Happening in Stores

Store feedback is key to merchandising success. One Door creates a unified channel for store feedback and gives you real-time insight into visual merchandising performance so you can stay on top of store experience quality.

Learn More

A Unified Visual Merchandising Platform

Store details, marketing campaigns, floorplans, and fixtures are a lot to manage for one visual merchandising team. With One Door ‘s platform, store plans are created and then communicated to the in-store team to visually guide them through execution. Our AI-based Computer Vision offers real-time visibility and feedback into each shelf, so compliance and feedback are handled in one, single solution.

Communicate

Close the feedback loop with field teams to quickly resolve issues that arise

Learn MoreAnalyze

Track performance and measure compliance with total visibility into store execution.

Learn More

“As we continue to tailor and localise our range in different stores, it’s important we draw on the best technology to make it simpler for our stores to execute for our customers.“

Doug Frank

General Manager Group Data & Analytics, Woolworths

“At Telstra, we are focused on delivering a superior customer experience across all our retail stores, One Door will allow us to consistently deliver regardless of each store’s unique footprint, tailor the experience based on customer preferences, and provide better transparency into store merchandising quality and compliance.”

Andrew Carlson

Head of Retail Operations, Telstra Retail

Resource Center

The AI-powered compliance solution for visual merchandisers.

Image IQ™ is an AI-powered compliance solution that helps visual merchandisers improve compliance, and save time and money.

The Importance of Transparent Data

Explore the importance of quick and transparent data in balancing HQ executives’ goals and helping visual merchandisers communicate them.

Paper planograms are a thing of the past. It's time to go digital with our platform

Planograms have been the standard approach to planning merchandising for decades. But as more and more retailers are...